Permex Petroleum Corporation Completes Transformational Acquisition of the Breedlove

Transaction Expected to Increase Permex’s Reserves by 240% through the Primary Formation; Additional Reserves Expected upon Further Evaluation of Formations Included on the Leases

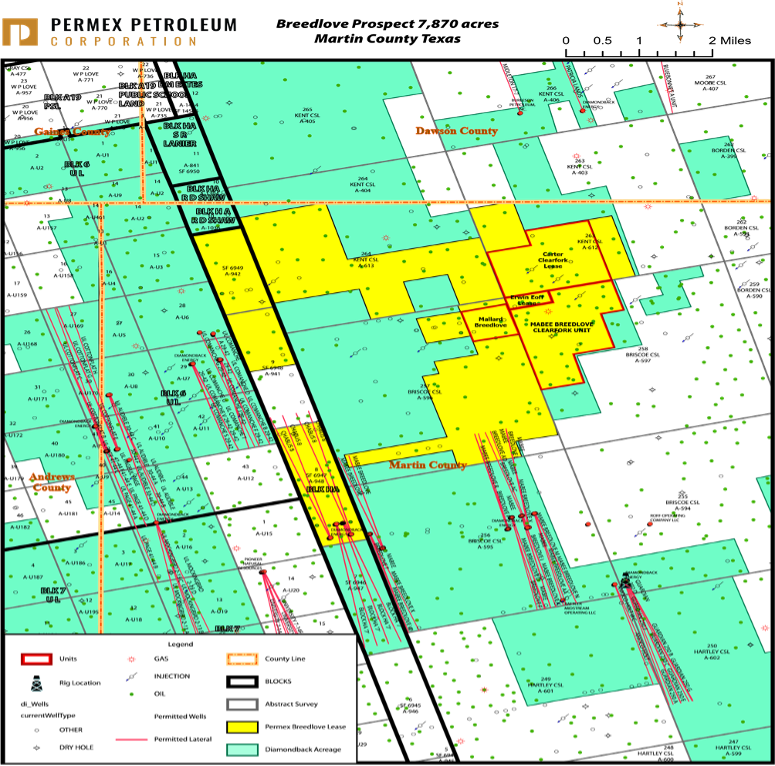

Vancouver, British Columbia, October 27, 2021 – Permex Petroleum Corporation ("Permex" or the "Company") (CSE: OIL) (OTCQB: OILCF), a leading junior oil and gas company, has completed the previously announced Purchase and Sale Agreement (“PSA”) with Pratt Oil Company, LLC, Rockport Permian, LLC and Petro America Resources, LLC (the “Seller”), and now holds 100% working interest in the Mabee Breedlove Clearfork Unit, Mallard Breedlove lease, Carter Clearfork lease and Erwin Eoff lease (the “Assets”) located in Martin County, Texas.

The Acquisition enhances Permex’s financial and operational strength through the addition of a high-quality and very low decline (5%) light oil asset base that is projected to generate robust free cash flow as additional workover and drilling programs are implemented by the Company. Further, the Acquisition is aligned with the Company’s strategy to acquire and develop undervalued, low-risk opportunities that support the building of a strong portfolio with strategic development upside. The Martin County Assets currently produce primarily from the ClearFork formation, however other formations are available under the leases for further development to increase field production.

Strategic Acquisition Highlights

- Attractive purchase price based only on the Proved Developed Producing (“PDP”) reserve.

- Increases Permex’s total oil and gas acreage holdings in Texas and New Mexico to 11,700 acres, an increase of approximately 290% since August 2021.

- Reserve growth is expected to be in excess of 240% through the primary formation Clearfork alone. Additional reserves will be booked upon further independent evaluation of the San Andres and Spraberry zones on the leases. Management expects to realize development of the locations starting in Q1 2022.

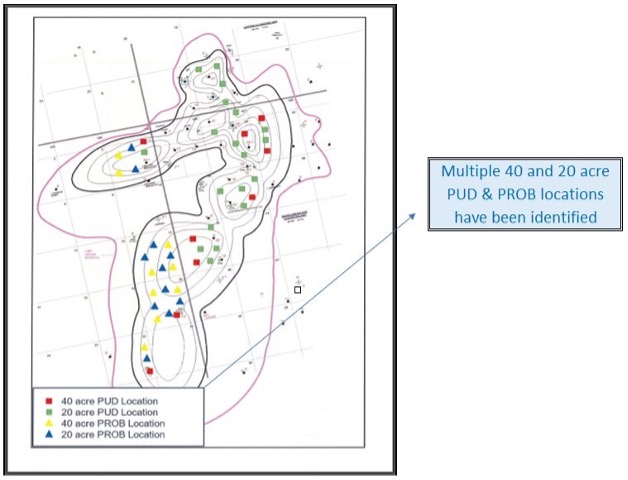

- Over 28 Proved Undeveloped (“PUD”) drilling locations and over 19 Probable (“PROB”) drilling locations identified to support long-term development. These additional locations could potentially add $159 million of PV-10 value, at a realized price of $65 per BOE.

- Exposure to multi-zone asset base concentrated in the Clearfork, San Andres and Spraberry formations with a large, identified low-risk drilling inventory of highly economic light oil plays, significant workover opportunities, and competitive forecast returns.

- The potential to generate significant annual free cash flow through the optimization, recompletion and Enhanced Oil Recovery (“EOR”) of current producing wellbores through Waterfloods.

A strong land position with offset drilling by Endeavor Energy and Diamond Back Energy.

“We are very pleased to complete this highly anticipated acquisition, which nearly triples our footprint of oil and gas holdings,” said Mehran Ehsan, CEO of Permex Petroleum. “This property not only provides additional drilling, re-entry and EOR opportunities, but also brings sufficient production to support future revenue and cash flow to strengthen our balance sheet. We believe the transaction metrics will be accretive in the near-term, elevating our market position and ultimately driving sustainable value for our shareholders.”

Additional locations could potentially add $159 million of PV-10 value at a realized price of $65 per BOE

About Permex Petroleum Corporation

Permex Petroleum (CSE:OIL) (OTCQB:OILCF) is a uniquely positioned junior oil & gas company with assets and operations across the Permian Basin of West Texas and the Delaware Sub-Basin of New Mexico. The company focuses on combining its low-cost development of Held by Production assets for sustainable growth with its current and future Blue-Sky projects for scale growth. The company, through its wholly owned subsidiary, Permex Petroleum US Corporation, is a licensed operator in both states; and owns and operates on Private, State and Federal land. For more information, please visit www.permexpetroleum.com.

CONTACT INFORMATION

Permex Petroleum Corporation

Mehran Ehsan Scott Kelly

President, Chief Executive Officer & Director CFO, Corporate Secretary & Director

(214) 459-2782 (778) 373-5421

Or for Investor Relations, please contact:

Brooks Hamilton

CAUTIONARY DISCLAIMER STATEMENT:

Neither Canadian Securities Exchange, OTCMarkets nor their Regulation Services Providers (as that term is defined in their respective policies) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking statements under applicable securities laws. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and the Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation. Although Management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. This news release does not constitute an offer to sell or solicitation of an offer to buy any of the securities described herein and accordingly undue reliance should not be put on such. Neither CSE, OTC Markets nor their Regulation Services Providers (as that term is defined in the policies of either exchange) accepts responsibility for the adequacy or accuracy of this release.