Annual CEO Letter to Shareholders

Dear Fellow Shareholders:

“The current downturn in our sector has been the longest and deepest downturn we have seen in 30 years, yet our company has not only been able to weather this storm through sustainable measures, but it continues on a growth trajectory”.

I would like to start by thanking you for your continued support through the volatility and trials that the energy sector endured in 2019. From world price fluctuations, excess supply and pipeline constraints to restricted access to capital, 2019 brought many struggles. Nevertheless, through it all I am pleased to say that Permex rose to the challenge and continues its progress. Again, I begin this annual letter to shareholders with a sense of pride about our company, employees and contractors associated with us. As I look back over the past 12 months - a period of profound political and economic volatility, specifically extreme hardship for oil and gas companies globally – it is remarkable that we not only weathered this storm, but have grown and strengthened our operations and balance sheet in conjunction with expansion of our corporate footprint.

In 2019, we continued to accelerate our focus on profitable properties while temporarily shutting down properties that were not profitable with lower WTI oil prices. For example, our McMurtry & Loving property which carries a certain amount of plugging liability was not profitable. As such we tested multiple zones within the Mississippi, Caddo and Strawn formations, of which none were commercially profitable at $50 - $55 WTI. In turn the field was temporarily shut down in order to avoid any additional capital and operational expenses as well unnecessary general and administrative overheads costs it carried. The fact Permex has a series of diverse properties helps, as it mitigates the risk of full shutdowns. To expand on this, imagine if Permex only had one field, such as many junior oil and gas operators. What would, and in fact has happened to these operators with one field in production, at lower oil prices which cannot be commercially viable, is that they would have no choice but to shut down the field. We have the privilege of shutting down one high cost field, versus other operators essentially shutting down all their operations, being the one field they own.

Performance Review

In 2019 we achieved solid operational results pushing our operating net backs per barrel to $42 as I write this letter. Production efficiency improved significantly and we exceeded the targets in our improvement programmes. The profitability of our industry continues to be challenged and the overall result of the company is highly affected by the decline in commodity prices. We continue to make strong progress and are stepping up the corporate efficiency programme to address the fundamental cost challenge in the oil and gas industry. Permex Petroleum’s fiscal-year 2019 revenue of $1.61 million increased 71% year on year over its 2018 fiscal year. This reflects a full year of activity and includes the shut down of wells on the Pittcock, Peavy and full field shut down on McMurtry & Loving. As mentioned above, some of the wells, and properties tested in the upper zones with no commercially viable production margins were shut in to avoid unnecessary cost burdens. Some of the performance highlights include:

- Oil & Gas Revenue increased by 71%

- Operating Cost per barrel decreased by 30%

- Net Oil Revenue increased by 110%

- General & Administration costs decreased by 51%

- Gross profit margin increased by 36%

- Net loss decreased by 69%

- Loss per share decreased by 80%

With the appropriate capital to devote to horizontal drilling programs, we expect substantial production growth from our operation in the Permian basin over the next several years as we transition from a vertical well asset base to horizontal wellbores with the drilling of 1 – 2 San Andres wells. Although market conditions may remain volatile, our portfolio is resilient. We are focused on creating value through a disciplined capital program that prioritizes efficient, low-risk, short-cycle investments. Our Upstream portfolio is anchored by large, long-lived assets with a low production decline.

Permian Basin: Permex and its working interest partners have been a fixture in the Permian Basin since early 2015, which is located in the southwestern United States within West Texas and Southeastern New Mexico. In 2018, Permex expanded its Permian oil and gas lease ownership by 25% to a gross 6,500 acre ownership in the region.

Management continues to monitor the field operations in order to maximize profitability while decreasing any ancillary risk associated with our properties and operations. These include shutting down unprofitable wells, and a review for potential divestiture of properties that have higher plugging liability and higher risk of development.

Reserves Highlights

- Proved developed producing (“PDP”) reserves decreased by 1.3%, from 659 mboe to 650 mboe

- Proved developed non-producing & shut-in reserves increased by 3.5% from 280 mboe to 290 mboe.

- Proved reserves (“1P”) increased by 10% from 439 mmboe to 486 mmboe

- Proved + Probable reserves (“2P”) increased by 6.5% from 9.1 mmboe to 9.8 mmboe),

- Permex maintains a strong reserves life index of 7.6 years based on 1P reserves and 13.4 years based on 2P reserves.

Our net asset value at year-end 2019, discounted at 10% is $144,585,160, estimated to be $3.61 per share. This is based on the estimated reserves value plus a value for undeveloped acreage, net of long-term debt and working capital.

Stock Performance

While we don’t run the company worrying about the stock price in the short run, in the long run our stock price is a measure of the progress we have made over the years. This progress is a function of continual investments, in good and bad times, to build our company through our people and oil and gas properties. These important investments drive the future prospects of our company and position it to grow and prosper for decades. Over the past 12 months our stock performed almost identically to peers within our sector in our operational region. That being said, from large cap to micro cap, 2019 was a year of terrible performance when the companies were reviewed solely based on their stock prices, even though some from operational stand point got stronger. We look forward to 2020 as positive consumer sentiment returns to the oil and gas sector helping company share prices to correct upwards to more appropriate and realistic valuations.

State of the Oil Market

From an industry standpoint, output in U.S. shale grew substantially in 2019, although at a slower rate than in years past. More importantly, as investors lose interest and capital markets become unfriendly, shale E&Ps are going to have an increasingly difficult time financing drilling outside of their own cash flow. As companies are forced to cutback in the pursuit of positive cash flow, supply growth will likely slow even further allowing oil prices to correct upwards.

Bankruptcies among U.S. and Canadian oil companies last year rose by 50 percent and could continue rising this year. In my opinion companies that continue operating at high costs, and have a high debt burden, will go under either through aggressive consolidations or bankruptcies. Shareholders have been getting impatient with oil companies, demanding higher returns and less of a focus on production expansion. As a result of this impatience, oil stocks have suffered one of their worst years in 2019.

Yet, one might argue that U.S. oil companies, at least, are digging their own grave by producing ever more oil. This record production has become the number-one factor moving oil prices or, as it happens, keeping them stable despite geopolitical risk spikes and production outages elsewhere. This is why when you attack a major oil facility in Saudi Arabia or kill an Iranian general or shut in all Libyan oil production, the prices don’t move.

In Canada, the industry is also struggling with falling investor confidence caused by complex and non-industry friendly regulation and a pipeline shortage that is restricting growth in oil production.

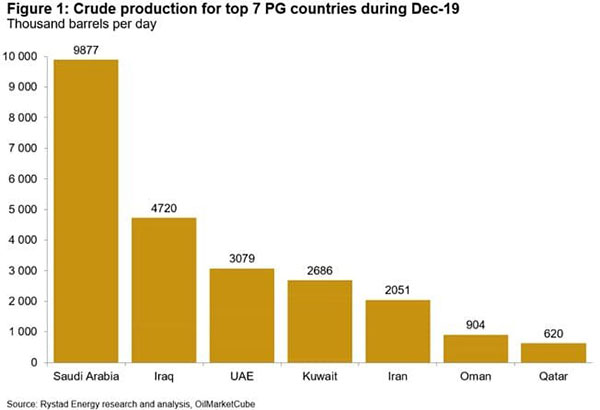

For the last few years, global supply balances often centered on the pace of demand growth versus the pace of U.S. shale growth. Chronic supply surpluses occurred because shale grew much faster than consumers could digest it. OPEC felt compelled to cut back several times – and on an ongoing basis – in order to try to balance out the difference. Below chart showcases the production for the top 7 PG countries during December 2019.

We continue to take an active approach to sustainability. To Permex, sustainability is a business matter where the need to remain highly competitive is strengthened by our efforts to accelerate the development of lower risk properties. We have an ambition to not only increase our production, free cashflow, but enhance corporate presence by expansion into the Dallas market as well as seeking graduation on the stock exchange as share price correction occurs. We are well prepared to deal with the volatility in our markets and the demanding situation for the industry and have the competency, capacity and leadership capabilities necessary to meet the challenges that lie ahead. I look forward to further strengthening Permex in 2020, pursuing the shareholder priorities while preparing to capture the opportunities when the market turns towards the upside.

On Behalf of your Permex Team,

Mehran Ehsan

Chief Executive Officer